22+ regulation h mortgage

Regulation H is issued by the Bureau of Consumer Financial Protection to implement the Secure and Fair Enforcement for Mortgage Licensing Act of 2008. Ad Check Todays Mortgage Rates at Top-Rated Lenders.

Fp0021483 50 Jpg

Ad See How Competitive Our Rates Are.

. Veterans Use This Powerful VA Loan Benefit for Your Next Home. Ad 10 Best Home Loan Lenders Compared Reviewed. 12 CFR 20822 b 1 iv A.

Comparisons Trusted by 55000000. Apply Today Save Money. Web Section 2081 Authority purpose and scope.

Web Regulation H permits a state member bank to make public welfare investments for the purpose of investing in developing rehabilitating managing selling or renting residential property provided that a majority of the units will be occupied by LMI persons. In an irregular transaction subject to a 14 of 1 percentage point tolerance if the actual annual percentage rate is 900 percent and a 75 omission from the finance charge corresponds to a rate of 850 percent that is considered accurate under 102622a4. Specifies that the regulation applies to state member banks and to state banks applying for membership in the.

Compare Apply Directly Online. Web jointly issued regulations on August 29 1996 61 FR 456844 The 1994 Act also made the flood insurance requirements directly applicable to the loans pur-chased by the Federal. Web This part known as Regulation H is issued by the Bureau of Consumer Financial Protection to implement the Secure and Fair Enforcement for Mortgage Licensing Act of.

Lock Your Rate Today. Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Calculate Your Payment with 0 Down.

Web 12 CFR Part 1008 - SAFE. Get Instantly Matched With Your Ideal Mortgage Lender. Mortgage Licensing ActState Compliance and Bureau Registration System Regulation H Most recently amended April 28 2016 Regulation H describes certain requirements for SAFE Act compliant state mortgage loan originator licenses and for the Nationwide Mortgage Licensing System and Registry.

Web Subpart E of Regulation H 12 CFR part 208 subpart E is issued by the Board of Governors of the Federal Reserve System pursuant to section 304 of the Federal Deposit. Web The commenter that supported the Proposed Rule stated that the registration of mortgage loan originators is burdensome for a small community bank that originates. Its Fast Simple.

Low Interest Online Lenders Comparison Reviews Top Brands Free Online Offers.

Development Downtown Pasadena Neighborhood Association

Ex 99 1

Wallstreetjournaleurope 20160812 The Wall Street Journal Europe Pdf Al Nusra Front Bashar Al Assad

Macroeconomics Pdf Production Function Interest

Reforms And Their Effects Part Ii The Israeli Economy 1995 2017

Non Qm S Meteoric Rise Is Leading The Private Label Rmbs Comeback S P Global Ratings

A Complete Guide To The Safe Mortgage Licensing Act Surety Solutions A Gallagher Company

Pdf Integration Of Environmental Policy Into The European Energy Policy Dacinia Crina Petrescu Academia Edu

Fascinating Truths About Women In Igbo Pre Colonial Society Kulture

Cone 20211231

Mary Ann Kosinski Preferred Rate

Dev Prakash Shukla Delivery Manager Wipro Linkedin

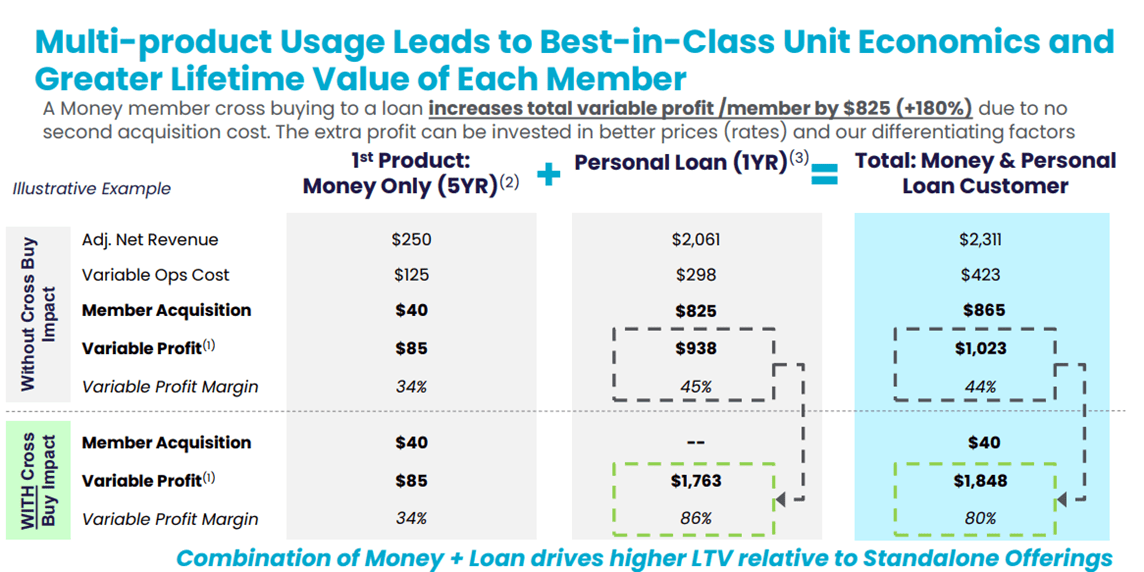

Sofi Technologies Stock A Next Generation Banking Disruptor Nasdaq Sofi Seeking Alpha

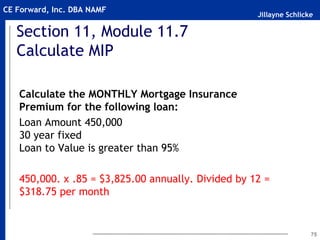

Loan Originator Pre Licensing And Exam Prep

Sustainable Housing Energy Systems Center For Sustainable Climate Solutions

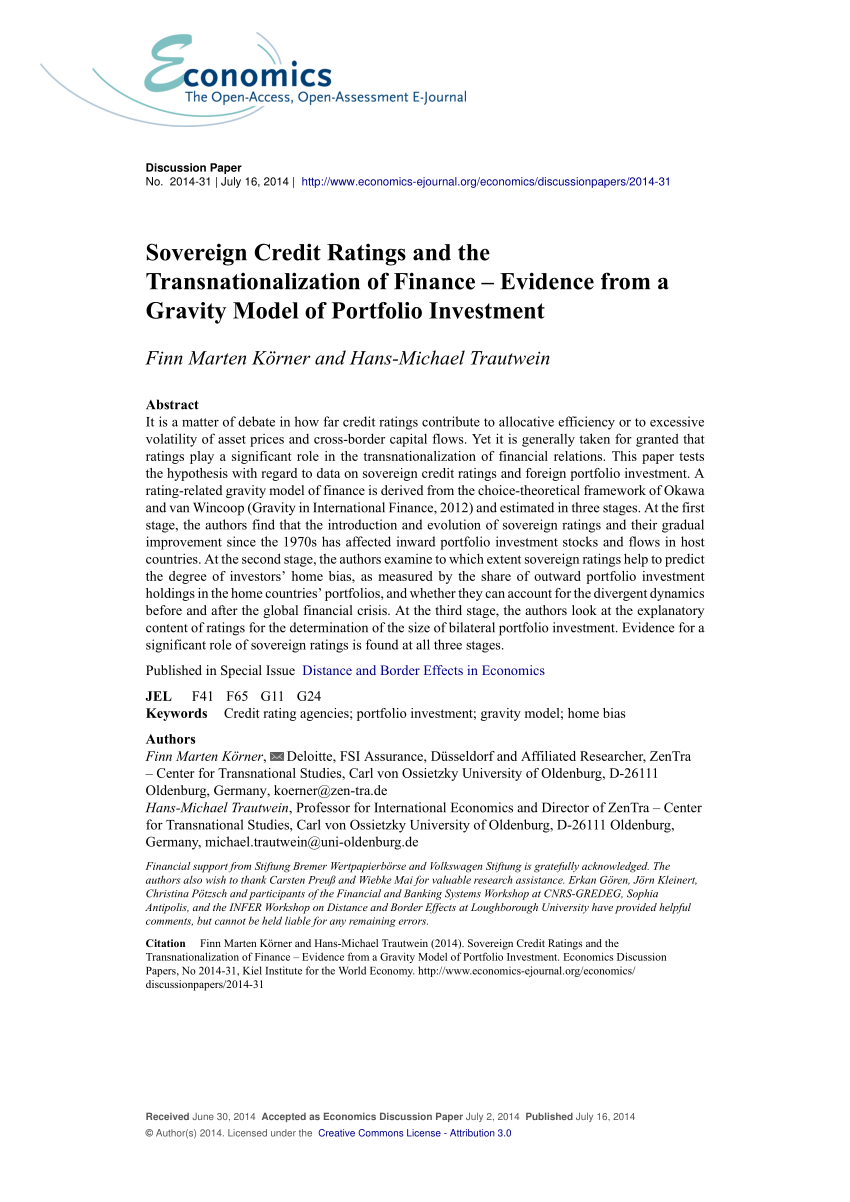

Pdf Sovereign Credit Ratings And The Transnationalization Of Finance Evidence From A Gravity Model Of Portfolio Investment

S A F E Mortgage Licensing Act Regulations G And H Us Consumer Financial Protection Bureau Regulation Cfpb 2018 Edition By The Law Library Paperback Barnes Noble